Written by Nathan Young | Group Strategy Director at Periscope

The number one question our clients ask us is, “When do you think this will all be over?”

Unfortunately, there is no simple answer. A wide range of factors will impact how quickly we can effectively respond to the virus and recover from its economic impact.

But as we approach a phased re-opening of the economy, it is worth evaluating the many models that exist and attempting to chart out a timeline for what lies ahead. Though the answers may be far from exact, four key questions form the basis for predicting when the COVID-19 crisis will be over and what life will look like when we emerge from the rubble.

When will the pandemic end?

In remarks made to conservative talk radio host Rush Limbaugh, Vice President Mike Pence expressed optimism that our darkest days of this pandemic are behind us.

“I truly do believe if current trend lines hold, that by early June, we could largely have this coronavirus epidemic behind us, and begin to see our nation open back up and go back to work,” Pence said.

Indeed, daily deaths from COVID-19 are falling or plateauing in many areas across the country, including in hard-hit states like New York. But with each state recording its first case on a different date and applying different social distancing measures, it is premature to spike the football.

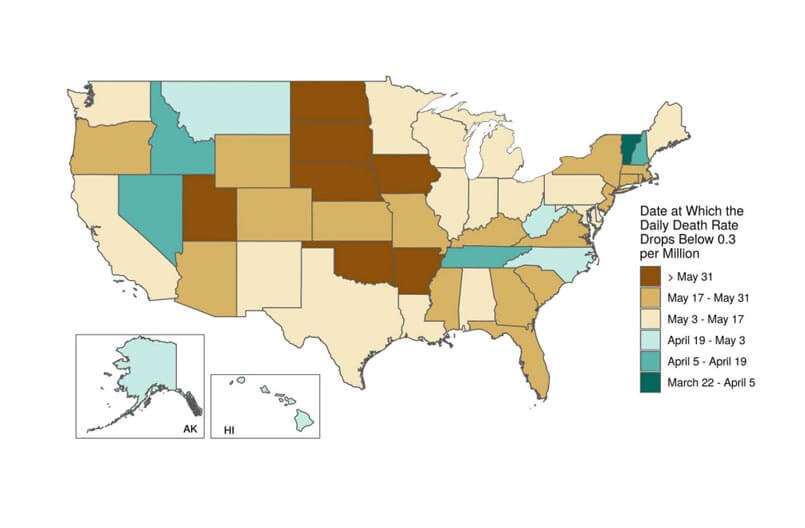

Source: University of Washington IHME

According to the University of Washington’s Institute for Health Metrics and Evaluation (IHME), a leading U.S. forecaster for COVID-19, a death rate of 0.3 per million or lower would indicate an end of pandemic conditions. Based on IHME analysis, the U.S. pandemic is expected to subside sometime between May 4th and June 29th, 2020.

Critics of the IHME model say it is too optimistic, warning that the methodology the model uses does not account for the unique characteristics of COVID-19 and it assumes the substantial social distancing measures currently in place will remain constant. With the White House preparing to issue guidance on a phased removal of those measures, many fear that a resurgence of the virus’ spread will decimate our country’s early gains.

When will social distancing directives subside?

To answer this question accurately, it is important to make a distinction between the current, relatively strict “stay-at-home” directives most of the country is under and “social distancing” directives, which cover a broad range of tools to mitigate the spread of COVID-19. Social distancing directives will likely include continued remote working, limits to the size of public gatherings and limited but mandatory stay-at-home orders for vulnerable populations. While broad stay-at-home orders will surely let up in the coming weeks, that is no indication that life will return to normal anytime soon.

A range of estimates for the end of social distancing directives have been floated by leading researchers and thought leaders in the field. Among the most extreme estimates comes from Harvard’s T.H. Chan School of Public Health. Researchers there conclude that “prolonged or intermittent social distancing may be necessary into 2022.” That estimate isn’t as farfetched as it sounds.

“While broad stay-at-home orders will surely let up in the coming weeks, that is no indication that life will return to normal anytime soon.”

More optimistic estimates come from prominent think tanks like the American Enterprise Institute (AEI) and the Center for American Progress (CAP), which agree that some form of social distancing measures will likely have to be observed for up to 18 months. They paint a picture of a gradual return to social interaction, where small gatherings with friends and family are allowed, but large social gatherings and airline travel are still heavily restricted.

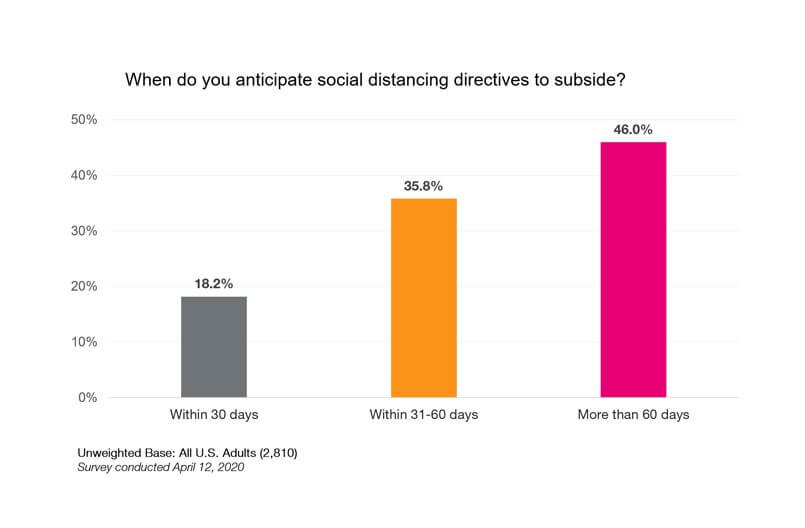

Source: Proprietary Periscope Research

These estimates contrast sharply with the U.S. consumer’s expectations. In a poll of U.S. consumers, Periscope discovered a split opinion: Nearly half (46%) of Americans believe that social distancing directives will subside more than 60 days from now, while a slight majority (54%) believe that social distancing will subside within 60 days. Only 21.2% believe that social distancing will last more than 90 days.

Ultimately, the question of when social distancing will end hinges on three critical factors:

- The clear and consistent communication and execution of a phased reduction of social distancing directives.

- The rapid ramp-up of U.S. testing and tracing capabilities.

- The development of more effective therapeutics and/or a scalable vaccine.

Businesses should follow directives from their state leadership closely and keep an eye on how these factors evolve over time.

When will consumers return to normal behavior?

This question is easy to address: they won’t. Though many Americans are eager to return to life pre-COVID, 42% report that the way they shop will fundamentally change as a result of the outbreak. Instead, businesses should prepare for a “new normal” to emerge.

Economic anxieties are likely to persist – and not just for the duration of the crisis, but well after COVID-19 has been brought to heel. Data from past recessions suggests that even for the most well-off among us, worries about the economy are long-lasting. Expect U.S. consumers to cut discretionary spending and be more cautious about making large purchases, but continue to monitor consumer confidence indicators closely.

Use of eCommerce is likely to continue to grow for the duration of this crisis and is unlikely to snap back. Grocery shopping via eCommerce will likely see the most dramatic shift, but the trend toward eCommerce in other segments will accelerate as well. Overall, online sales have surged 49% according to Adobe Analytics. This does not necessarily portend doom for brick and mortar retailers however: curbside pickup orders have spiked 208%, suggesting that retailers who evolve their online presence and in-store operations will weather the storm.

The shift to remote work is likely to take hold permanently. Once viewed as a far-off future state driven by demand from Millennial and Gen Z workforces, the COVID-19 crisis has, in a rather unwieldy experiment, proven that remote work works. Though many will return to the office, many more will elect not to, forcing businesses to offer new processes and technologies to accommodate remote workers. A silver lining? Businesses who adopt distributed workforce strategies will benefit from lower overhead and a better ability to attract talent from outside markets.

Similarly, all manner of digital consumption is likely to accelerate. From online streaming to online gaming, from social media to digital news, Americans are likely to continue to spend more time online in the short and long term.

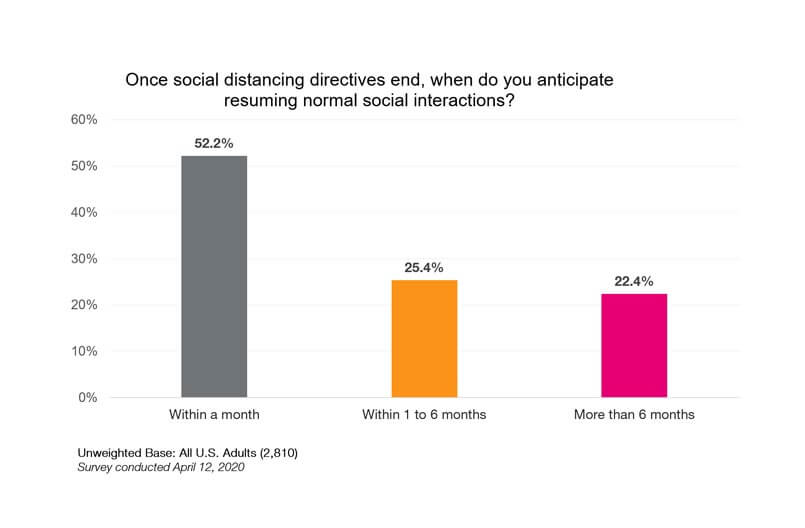

Source: Proprietary Periscope Research

But that doesn’t mean socializing in person is out. In a poll of U.S. consumers, Periscope found a strong desire to return to normal life, with 52.2% of U.S. consumers reporting that they expected to resume normal social interactions within a month after their state social distancing directives ended.

When will the economy recover?

Former FDA commissioner Scott Gottlieb, one of the architects of the AEI report, anticipates that “this is going to be an 80% economy.” An optimistic reading of this estimate would suggest that things will largely return to normal, but compared to the Great Recession (a 4.3% decline in GDP) and the Great Depression (a 10% decline in GDP), Gottlieb’s off-the-cuff estimate is startling.

Leading economist David Rosenberg predicts even more bloodletting. In a worst-case scenario estimate in which no vaccine is developed and the country sees a resurgence of COVID-19 cases, Rosenberg predicts a 30% drop in real GDP and an average unemployment rate of 13%.

Though both of these estimates dwarf the Great Recession, it is important to recognize that the fundamental mechanisms of our economy are good. There is no liquidity crisis. Banks are not collapsing. Stimulus is being applied early and often.

In other words, the damage to the economy is directly correlated to social distancing measures. Thus, the best estimate for when the economy will recover is the best estimate for when social distancing measures will subside completely – about 18 months from now.

This is nearly the exact amount of time it took for the U.S. to recover from the Great Recession. Businesses would be wise to evaluate which responses worked and which didn’t work during that period. History has shown that across-the-board cuts to advertising spend are unlikely to result in growth. Instead, businesses would be wise to evaluate their portfolio of products and services’ historical performance in recessions, and reallocate spend to focus on identifiable growth opportunities.

Identifying those growth opportunities relies heavily on solid data and analytics, but shifting numbers on a spreadsheet won’t be enough to right the ship. To be successful, it is critically important to understand the mindset of the consumer and forge strategies that help you communicate with empathy.

We are living through a time of great uncertainty. The volume of indicators and interrelation of driving factors makes definitive predictions all but impossible. The fog is thick. The road to recovery is long and winding. The risk is clear and present.

Unfortunately, this is not the beginning of the end, but rather the end of the beginning. Navigating this crisis successfully will require unwavering patience, close attention and proactive strategy. If you need help plotting your business’ trajectory, Periscope is here to help.